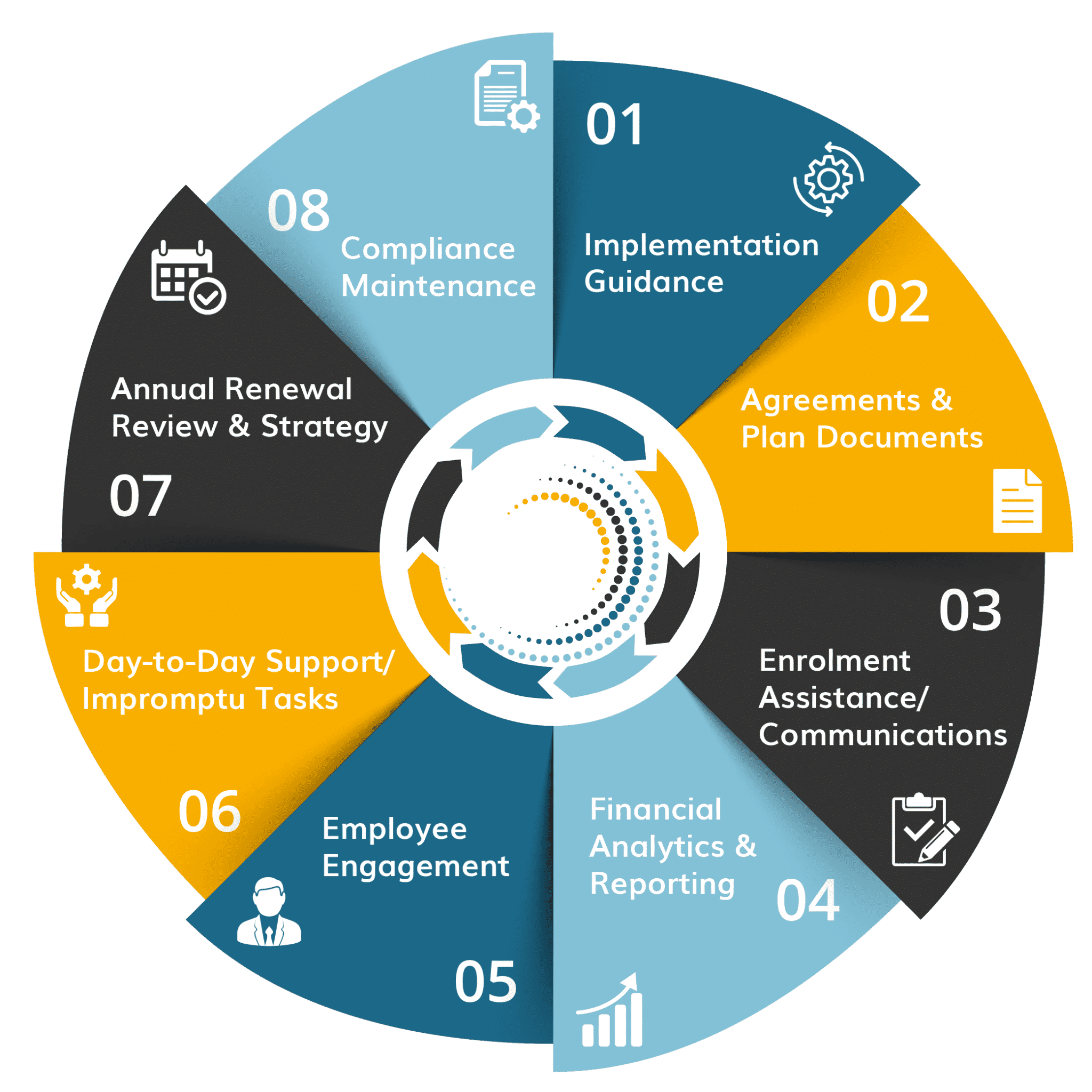

CORPORATE SERVICES

08: Compliance Maintenance

- Provide relevant information and expertise

- Compliance review

- Employee training & income equity

07: Annual Renewal Review & Strategy

- Pre-renewal analysis of financials and strategizing

- Proposal construction, review, and execution

- Negotiations and presentation of renewal

- Annual benchmarking

06: Day-to-Day Support/ Impromptu Tasks

- Eligibility concerns

- Plan/benefit inquiries

- Claims advocacy

- Account management issues

- Insurer customer service inquiries

- Miscellaneous health and welfare inquiries

- Insurer performance management

- Special requests/projects (as directed)

- HR department support

05: Employee Engagement

- Monitoring trends and developing communication strategies

- Event planning and project management

- Promoting employee education and plan developments

- Employee inquiry support

01: Implementation Guidance

- Benchmarking to the US or Global Plans and Canadian market practice, and current trends

- Financial Analysis of total estimated costs

- Education on differences between Canada and other countries

- Assess and prepare applications

- Review implementation timelines

- Review proposed agreements

- Participate in implementation meetings

- Monitor progression

- Ensure appropriate taxation at implementation

02: Agreements & Plan Documents

- Review accuracy of plan designs, modifications, certificates, and amendments

- Provide feedback on all administrative agreements and contracts

- If required, liaise between legal counsel and vendors

03: Enrolment Assistance/ Communications

- Communication strategies, creation, review & support, as requested

- Onsite, in-person & recorded enrolment assistance

04: Financial Analytics & Reporting

- Plan design review

- Annualized forecasting projections

- Financial analysis and reporting

- Quarterly claims review

- High-cost claimant analysis

- Pre-emptive cost-driver and cost-avoidance advice

Process

Marketing creates an opportunity to review your needs and expectations. You will experience lower prices in a highly competitive market, new technology designed to improve service, and possibly off-load more administration to the insurer. Our approach to marketing builds on our recommended service standards including your own standards to ensure more consistent high service levels across the organization.

Establish your selection

criteria & service

standards

The level of service currently being delivered provides a benchmark test and assists in identifying the necessary improvements.

First cut

of insurers

Pre-qualify the insurance companies based on their commitment to meet or exceed the performance standards you have set. Only those insurers who commit to meeting (or exceeding) your standards, and whose references support their ability to perform, will receive consideration.

Request for

proposals

In the interest of reducing demand on your time and resources, Owen & Associates will request of you or your current carrier, the data required to market your account. We will prepare the specifications and review the document with you prior to release to the marketplace. We will also respond to all questions from the carriers and analyze the quotations against your selection criteria.

Reports &

recommendations

With your long-term goals in mind, Owen & Associates will review the insurer proposals and outline concrete recommendations with supporting rationale.

Implementation

& review

Assistance with all aspects of the policy implementation including basic set up, enrolment and education, documentation review and other items.

Follow-up

modification

Managing the employee benefits program within cost and quality objectives, to respond to diverse corporate and employee needs, and to keep the benefit plans dynamic as your corporate culture evolves. As your corporate outlook changes, the benefits investment must adapt to new expectations and new realities.

Process

Marketing creates an opportunity to review your needs and expectations. You will experience lower prices in a highly competitive market, new technology designed to improve service, and possibly off-load more administration to the insurer. Our approach to marketing builds on our recommended service standards including your own standards to ensure more consistent high service levels across the organization.

Establish your selection criteria & service standards

The level of service currently being delivered provides a benchmark test and assists in identifying the necessary improvements.

First cut of insurers

Pre-qualify the insurance companies based on their commitment to meet or exceed the performance standards you have set. Only those insurers who commit to meeting (or exceeding) your standards, and whose references support their ability to perform, will receive consideration.

Request for proposals

In the interest of reducing demand on your time and resources, Owen & Associates will request of you or your current carrier, the data required to market your account. We will prepare the specifications and review the document with you prior to release to the marketplace. We will also respond to all questions from the carriers and analyze the quotations against your selection criteria.

Reports & recommendations

With your long-term goals in mind, Owen & Associates will review the insurer proposals and outline concrete recommendations with supporting rationale.

Implementation & review

Assistance with all aspects of the policy implementation including basic set up, enrolment and education, documentation review and other items.

Follow-up modification

Managing the employee benefits program within cost and quality objectives, to respond to diverse corporate and employee needs, and to keep the benefit plans dynamic as your corporate culture evolves. As your corporate outlook changes, the benefits investment must adapt to new expectations and new realities.