CORPORATE SERVICES

A group retirement savings plan can be an integral piece of a group benefits plan. These plans provide employees with financial security and a strong connection to their company. Owen & Associates offers numerous years of experience in the retirement planning industry providing advice to a wide range of pension plan sponsors in both the private and public sectors. Our team will assist in structuring the appropriate type of plan.

Like our Group and Administration Services, our Retirement Services take a collaborative approach, whereby each of our clients has access to vendor actuaries with direct client knowledge. Our team provides day-to-day support on a dedicated basis and supports.

Group Retirement Program Plan Design and Review Services

Plan Document Creation and Review Services

Direct Administration Services

Regular Stewardship Reporting for CAP Plans

Pension Plan Regulatory Support

Employee Communication and Engagement

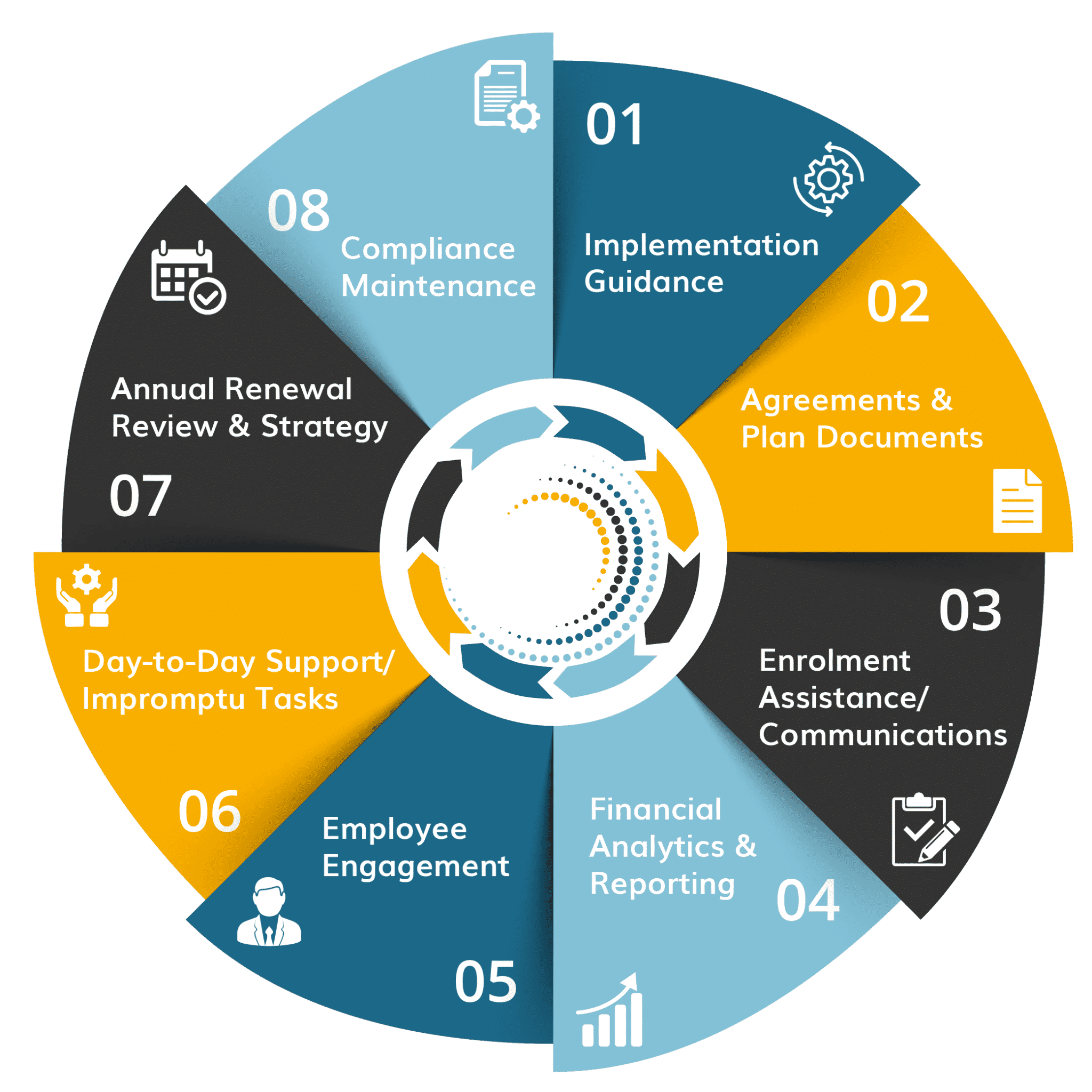

08: Compliance Maintenance

- Provide relevant information and expertise

- Compliance review

- Retirement program reporting and CAP guidelines

- Ongoing tax reporting support

07: Annual Renewal Review & Strategy

- CAP Reporting

- Pension Reporting

- Proposal construction, review, and execution

- Fund Fee reduction negotiations

- Annual review

06: Day-to-Day Support/ Impromptu Tasks

- Eligibility concerns

- Plan inquiries

- Withdrawal inquiries

- Account management issues

- Insurer customer service inquiries

- Miscellaneous inquiries

- Insurer performance management

- Special requests/projects (as directed)

- HR department support

05: Employee Engagement

- Monitoring trends and developing communication strategies

- Event planning and project management

- Promoting employee education and plan developments

- Financial Wellness

- Employee inquiry support

01: Implementation Guidance

- Benchmarking to US or Global Plans and Canadian market practice, and current trends

- Financial Analysis of total estimated costs

- Education on differences between Canada and other countries

- Assess and prepare applications

- Review implementation timelines

- Review proposed agreements

- Participate in implementation meetings

- Monitor progression

- Ensure appropriate taxation at implementation

02: Agreements & Plan Documents

- Review accuracy of plan designs, modifications, certificates, and amendments

- Provide feedback on all administrative agreements and contracts

- If required, liaise between legal counsel and vendors (if required)

03: Enrolment Assistance/ Communications

- Communication strategies, creation, review & support, as requested

- Onsite, in-person & recorded enrolment assistance

- Ongoing regular employee education

- Financial Wellness

04: Financial Analytics & Reporting

- Plan design review

- Annualized forecasting projections

- Pension Reporting Requirement guidance

- CAP Guideline Reporting

- Fund Performance Review and Recommendations

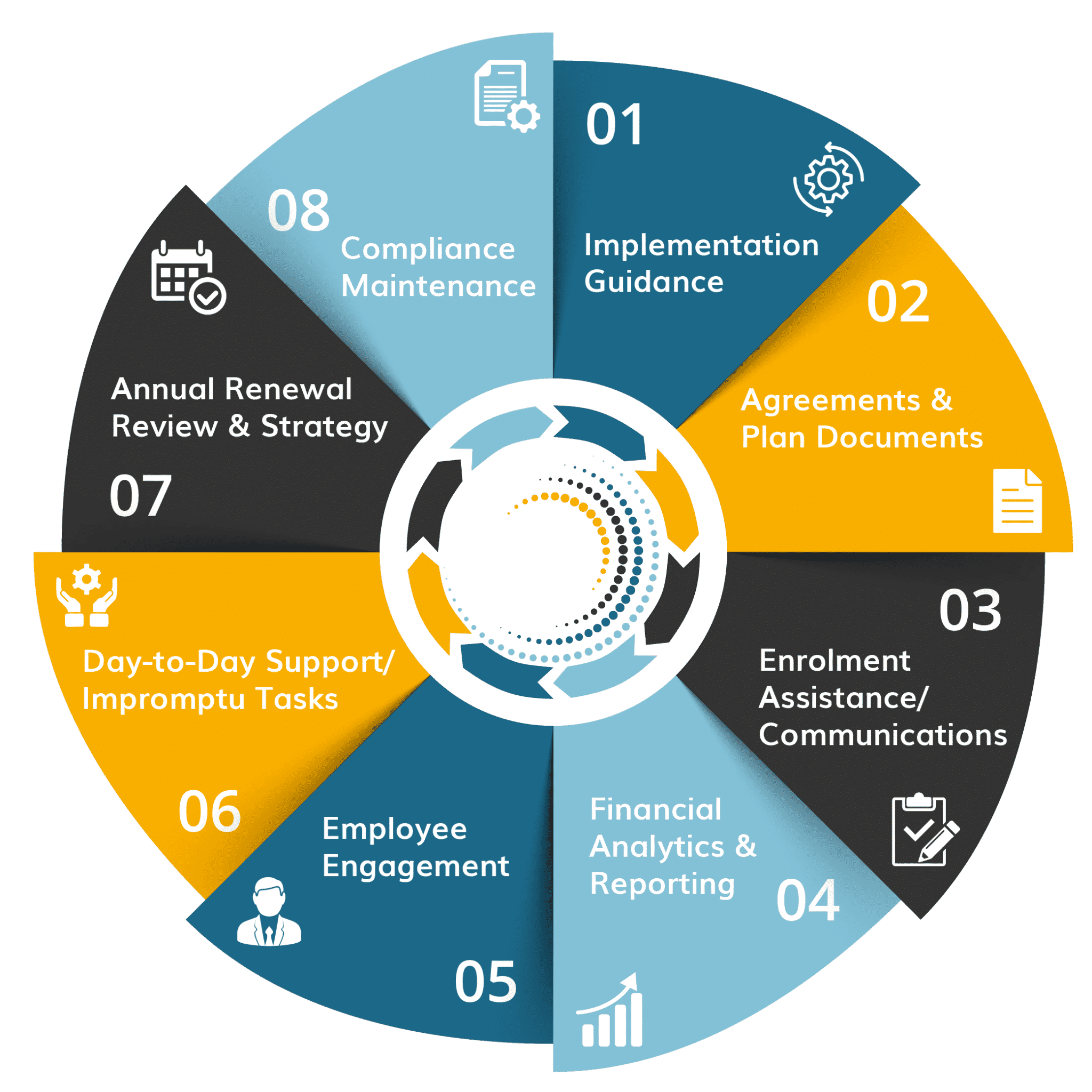

01: Implementation Guidance

- Benchmarking to US or Global Plans and Canadian market practice, and current trends

- Financial Analysis of total estimated costs

- Education on differences between Canada and other countries

- Asses and prepare applications

- Review implementation timelines

- Review proposed agreements

- Participate in implementation meetings

- Monitor progression

- Ensure appropriate taxation at implementation

02: Agreements & Plan Documents

- Review accuracy of plan designs, modifications, certificates, and amendments

- Provide feedback on all administrative agreements and contracts

- If required, liais between legal counsel and vendors (if required)

03: Enrolment Assistance/ Communications

- Communication strategies, creation, review & support, as requested

- Onsite, in-person & recorded enrolment assistance

- Ongoing regular employee education

- Financial Wellness

04: Financial Analytics & Reporting

- Plan design review

- Annualized forecasting projections

- Pension Reporting Requirement guidance

- CAP Guideline Reporting

- Fund Performance Review and Recommendations

05: Employee Engagement

- Monitoring trends and developing communication strategies

- Event planning and project management

- Promoting employee education and plan developments

- Financial Wellness

- Employee inquiry support

06: Day-to-Day Support/ Impromptu Tasks

- Eligibility concerns

- Plan inquiries

- Withdrawal inquiries

- Account management issues

- Insurer customer service inquiries

- Miscellaneous inquiries

- Insurer performance management

- Special requests/projects (as directed)

- HR department support

07: Annual Renewal Review & Strategy

- CAP Reporting

- Pension Reporting

- Proposal construction, review, and execution

- Fund Fee reduction negotiations

- Annual review

08: Compliance Maintenance

- Provide relevant information and expertise

- Compliance review

- Retirement program reporting and CAP guidelines

- Ongoing tax reporting support